The National Small Business Association (NSBA) recently released a survey of 780 small business owners (businesses with 500 or fewer employees) across a number of business types including manufacturing (15%).

Among the key findings are:

- The vast majority of those surveyed (87%) believe that offering employee health care benefits is very or somewhat important to attracting and retaining good employees.

- The smaller the business, the more likely that the owner, alone, is responsible for managing the healthcare benefit.

- Not surprisingly, the cost of the healthcare plan is the number one issue in deciding whether or not to offer the benefit.

- One-third of the small businesses surveyed say they have held off on hiring new employees “as a direct result of rising healthcare costs.”

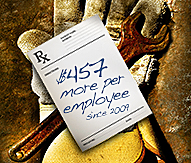

- The survey respondents report that the average increase in cost to insure each employee has risen $457 since 2009.

- 58% of those surveyed indicate they do not have a clear understanding of the implications of the Affordable Care Act (ACA).

These rising healthcare costs and concerns over the impact of the ACA are forcing small business owners to make difficult decisions about the future of employee healthcare benefit. Possible options cited in the survey include (1) increasing employee contributions; (2) reducing the scope of benefits offered; (3) dropping healthcare insurance altogether and providing some additional money to employees so they can obtain their own healthcare plans.

While this study raises a number of significant concerns for small business owners, before making any decisions it would be wise to engage an experienced benefits management company that is well versed on the present healthcare situation and the expected impact of the Affordable Healthcare Act. As always, employers must balance the cost of employee benefits and the overall effect on the well being of both the business and the employees.